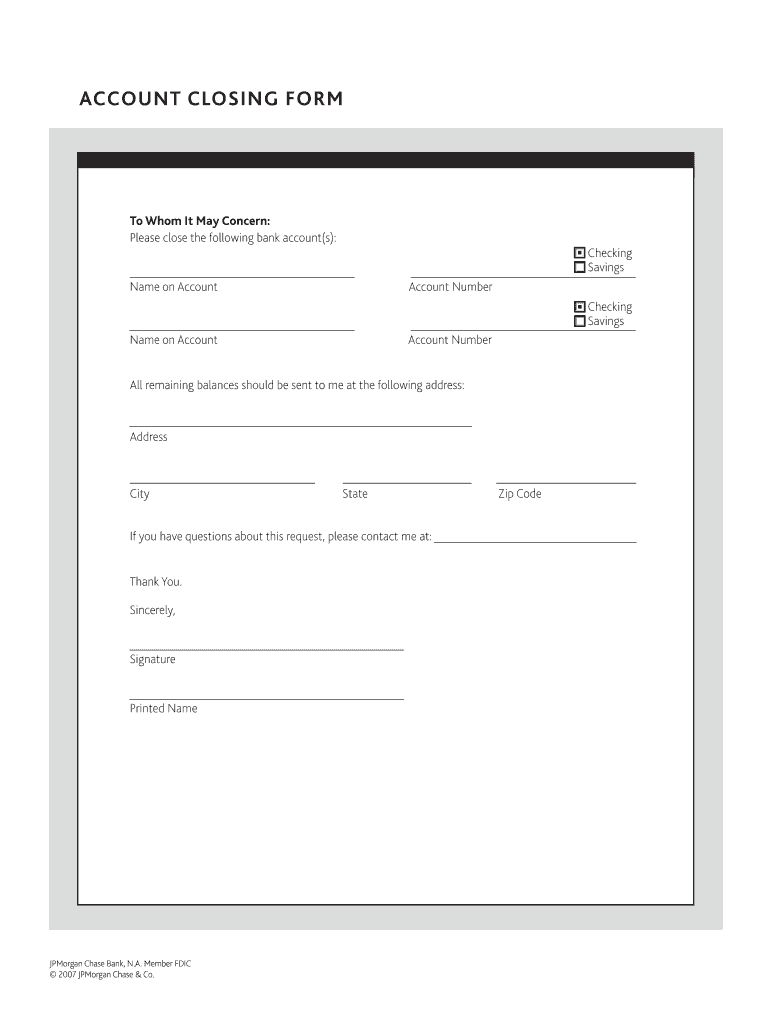

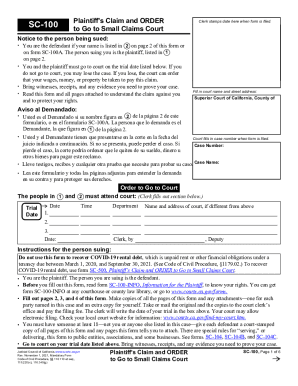

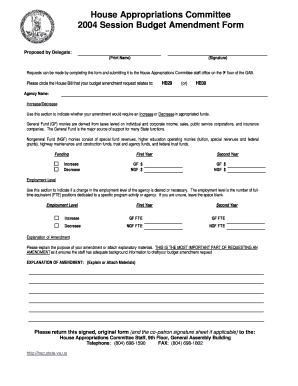

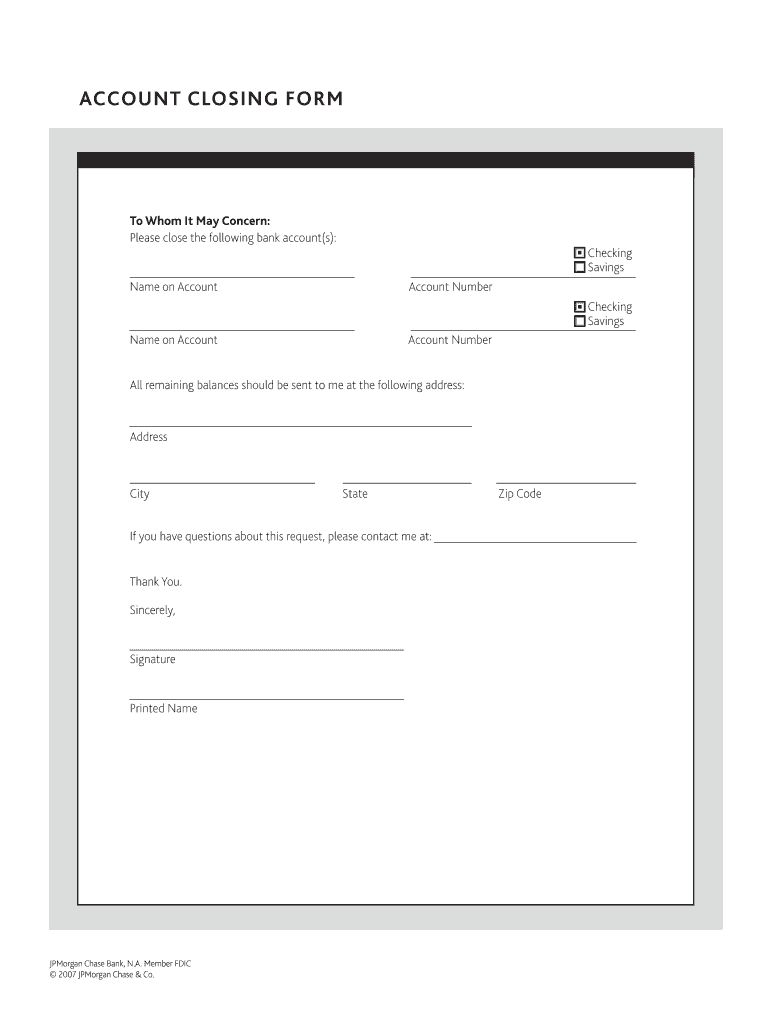

Get the free account closing form

Get, Create, Make and Sign

Editing account closing online

How to fill out account closing form

How to fill out a bank closing form:

Who needs a bank closing form:

Video instructions and help with filling out and completing account closing

Instructions and Help about closing bank account letter template form

So hopefully you're pretty excited that we're going to be finishing off the accounting cycle I know I am because I wanted to start on the merchandise inventory videos, and before we get to that actually had to finish up this last presentation regarding closing entries so where we left off last time was temporary and permanent accounts which is going to help us understand how to close those or those temporary accounts so if you remember from last time those temporary accounts are our read accounts which are revenue accounts expenses and dividends so how are we going to get rid of these balances because that's what we need to do for these temporary accounts well what we're going to do is for instance if we have five thousand dollars of revenue and you kind of remember that revenue does have a credit balance well what we're going to do in order to bring this balance down to zero is we're going to do the opposite by debiting revenue by five thousand dollars that way we're going to have a final balance of zero and our temporary account will be zeroed out, so that's exactly what we're going to do in this tutorial we're going to clear those temporary account balances and transfer them to a permanent account which you know now is retained earnings so let's get on that, and I actually created some balances for this presentation I have an income statement with revenues expenses and I actually do want to put up that dividends for this tutorial are going to be one thousand dollars let me just put that up here at the top dividends are one thousand all right so how are we going to actually close out these accounts well we're going to do them in a specific order we're going to first close out revenues secondly we'll close out expenses, and then we're going to close out our last temporary account which is dividends last so let's do this let's start with revenues, so revenues have a balance of $10,000 and if you remember revenues have a balance that is credit so in order to reduce revenues down to zero what we're going to do is we're going to take revenues and debit them $10,000 this way they have a balance of zero in this account now what's going to be our credit entry well revenues have nothing to do with expenses, but revenues actually contribute to net income, so we're going to transfer the balance and revenues to net income or our account which is called income summary, so income summary is net income we're just transferring the revenues to income summary or net income for just the meantime now let's close out our second temporary account which is expenses, so expenses normally have a debit balance in all of our expense accounts, so we're going to credit them, so we're going to credit each one of these you can't just you can't just summarize them and say expenses or credit we're going to do each one of them so salaries expense will be credited, or I should say salaries expense will be credited for what $1500 will have utilities expense beam I forgot the S...

Fill account close form : Try Risk Free

People Also Ask about account closing

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your account closing form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.